The British Independent Retailers Association (Bira) has welcomed the Chancellor’s announcement of plans to create a level playing field for British businesses against unfair international trade practices.

This announcement, made by Chancellor Rachel Reeves this week, represents a significant step forward in addressing concerns that Bira has consistently raised on behalf of its members.

The Association has been campaigning for independent retailers over concerns about the damaging impact of cheap imports entering the UK duty-free and often avoiding VAT, creating unfair competition with responsible UK-based retailers.

The Chancellor’s decision to review the customs treatment of Low Value Imports – which currently allows goods valued at £135 or less to be imported without paying customs duty – directly addresses one of Bira’s key concerns. The system has disadvantaged British retailers by allowing international companies to undercut them, affecting high streets across the nation.

Bira’s ceo, Andrew Goodacre, commented: “This announcement validates what Bira has been pushing for on behalf of its members. Since our October conference, the ssociation has been working closely with BHETA and RAVAS – organisations aligned with Bira’s thinking – to bring these issues to the government’s attention. It is pleasing that the government has been listening and is now taking action.”

The government’s package of support includes increased assistance for businesses to report unfair practices, improved monitoring of trade data, and an acceleration of measures to deter import surges. These steps will help protect independent retailers.

Beyond the issue of duty-free imports, Bira continues to advocate for action on VAT avoidance. Online marketplaces must be held accountable for collecting VAT from sellers, as they are legally responsible for doing so. The safety concerns associated with many imported products also remain a significant issue that requires addressing.

Bira is urging the government to act quickly and decisively.

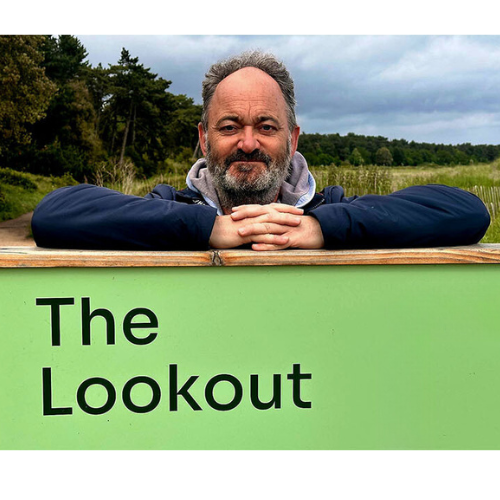

Top: The Chancellor Rachel Reeves.